Bank’s Profile

A BRIEF HISTORY OF THE BANK SINCE ITS INCORPORATION

| Year | Key Events |

|---|---|

| 1907 |

|

| 1921 | Bank’s capital was raised to Rs 60 lakhs from Rs 20 lakhs. |

| 1932 |

|

| 1941 | Singapore branch was opened. |

| 1957 | Bank celebrated its Golden Jubilee. |

| 1967 | Bank celebrated its Diamond Jubilee. |

| 1978 | Bank’s logo comprising of three circling arrows arranged around a central point was approved. |

| 1982 | Bank celebrated its Platinum Jubilee. |

| 1990 | Bank of Thanjavur Ltd. (BoT) with 157 branches was amalgamated with the Bank. |

| 2006 | The centenary year celebration was inaugurated by His Excellency the President of India Shri A. P. J. Abdul Kalam on 4th September. |

| 2007 | Bank went in for Initial Public Offer in February 2007. |

| 2008 | Achieved 100 per cent Core Banking Solutions (CBS) compliance. |

| 2019 |

|

| 2020 | Bank commenced its operations as an amalgamated entity from 1st April 2020. The integration of CBS systems of both the Banks was completed on 14.02.2021. |

| 2022 | Bank’s Global Business surpassed Rs 10 lakh Crores. |

| 2023 | Bank’s Global Business was at Rs 10.95 lakh Crores. |

| 2024 | Bank’s Global Business surpassed ₹12 lakh Crore. |

| 2025 | Bank’s Global Business stood at ₹13.25 lakh Crore. |

| Q2 FY26 | Bank’s Global Business stood at ₹13.97 lakh Crore. |

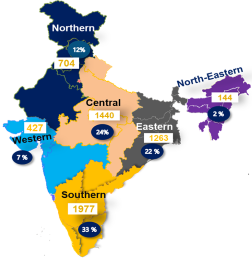

Branch Network and other touch points as on 30.09.2025

Domestic branches: 5955 (Including 3 DBUs) Overseas branches: 3 & IBU: 1

ATMs & BNAs: 5565 Business Correspondents: 15598

Bank’s Performance as on 30.09.2025

Assets and Liabilities

- Total Deposits increased by 12.09% YoY and reached to ₹776946 Cr in Sep’25 as against ₹693115 Cr in Sep’24. Current, Savings & CASA deposits grew by 11.40%, 6.59%, and 7.23% YoY respectively.

- Domestic CASA ratio stood at 38.87% as on 30thSep’25.

- Gross Advances increased by 12.65% YoY to ₹620324 Cr in Sep’25 from ₹550644 Cr in Sep’24.

- RAM (Retail, Agriculture & MSME) advances grew by 15.57% YoY to ₹375660 Cr in Sep’25 from ₹325050 Cr in Sep’24.

- RAM contribution to gross domestic advances stood at 65.50%. Retail, Agri & MSME advances grew by 18.58%, 13.98% and 14.10% YoY respectively. Home Loan (including mortgage) grew by 12.68% YoY in Sep’25.

- Priority sector advances as a percentage of ANBC stood above 42% at ₹206149 Cr in Sep’25 as against the regulatory requirement of 40%.

Capital Adequacy

- Capital Adequacy Ratio stood at 17.31%. CET-I at 14.80% and Tier I Capital stood at 15.27% in Sept’25.

Asset Quality

- GNPA decreased by 88 bps YoY to 2.60% in Sep’25 from 3.48% in Sep’24, NNPA reduced by 11 bps to 0.16% in Sep’25 from 0.27% in Sep’24.

- Provision Coverage Ratio (PCR, including TWO) improved by 68 bps YoY to 98.28% in Sep’25 from 97.60% in Sep’24.

Operating Profit and Net Profit (Half year ended Sep’25 over Sep’24)

- Net Profit up by 17.24% YoY to ₹5991 Cr in H1FY26 from ₹5110 Cr in H1FY25.

- Operating Profit grew by 4.08% YoY to ₹9607 Cr in H1FY26 from ₹9230 Cr in H1FY25.

- Net Interest Income up by 4.35% YoY to ₹12910 Cr in H1FY26 from ₹12372 Cr in H1FY25.

- Net Interest Margin (NIM) Domestic stood at 3.35% in H1FY26.

- Return on Assets (RoA) improved by 7 bps to 1.33% from 1.26% in H1FY25.

- Credit Cost improved by 41 bps YoY to 0.27% in H1FY26 from 0.68% in H1FY25.

Digital Banking

- Business of ₹1,23,585 Cr has been generated through Digital Channels in H1FY26. A total of 132 Digital Journeys, Utilities and Processes have been launched so far.

- Number of Mobile Banking users has grown by 17% year over year, reaching 2.11 Cr.

- UPI users and Net Banking users have witnessed an increase of 24% & 6% YoY reaching 2.41 Cr and 1.17 Cr respectively. Both the debit card & credit card users increased by 5%.

Financial Inclusion

- During Q2 FY26, total disbursement under SHG is ₹5287 Cr.

- The outstanding under SHG increased to ₹22901 Cr from ₹20790 Cr registering YoY growth of 10.2%. Bank assisted 5.06 lakh SHG/JLGs with 59 lakh women members under SHG/JLG scheme.

- In Atal Pension Yojana (APY), during H1FY26 Bank added 3.12 lakhs fresh enrolments with Average Account Per Branch (AAPB) of 54 against proportionate target of 50 as on 30.09.2025.

Awards & Accolades

- Indian Bank was awarded the third prize in the Rajbhasha Kirti Award 2025 for its exemplary efforts in promoting the official language.

- The Bank received the Cloud Leader- India 2025 award from VMware India in recognition of its leadership in cloud technology and innovation.

- The Chief Financial Officer of Indian Bank was honoured as the Best CFO in the Bank (Large Cap category) at DSIJ’s 2025 CFO Awards.

Our Focus

- Our focus remains on staying agile in a dynamic environment, building trust through transparency and delivering personalized experiences. We are investing in innovation, expanding access to underserved segments, and strengthening our foundation for long-term success.